Articles

- Page Path

- HOME > Osong Public Health Res Perspect > Volume 6(5); 2015 > Article

-

Original Article

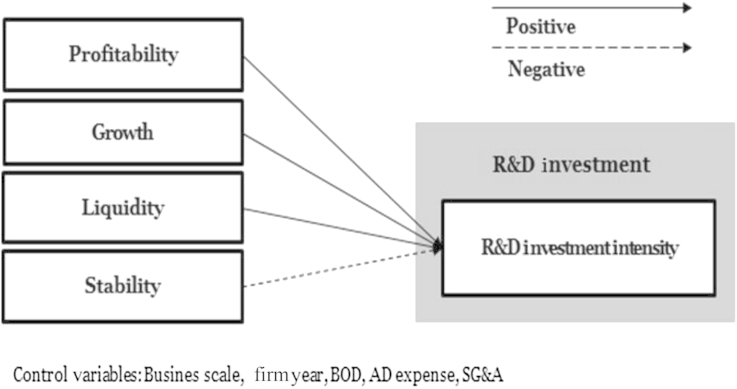

The Determinants of Research and Development Investment in the Pharmaceutical Industry: Focus on Financial Structures - Munjae Lee, Mankyu Choi

-

Osong Public Health and Research Perspectives 2015;6(5):302-309.

DOI: https://doi.org/10.1016/j.phrp.2015.10.013

Published online: November 6, 2015

School of Health Policy and Management, Korea University, Seoul, Korea

- ∗Corresponding author. emunjae@korea.ac.kr

• Received: May 27, 2015 • Accepted: October 6, 2015

Copyright © 2015 Korea Centers for Disease Control and Prevention. Published by Elsevier Korea LLC. All rights reserved.

Figure & Data

References

Citations

Citations to this article as recorded by

- How Indian Pharma Industry Performed in the Last Decade? Impact of a Non-macroeconomic Variable and Financial Distress

Pooja Singh, Anindita Chakraborty

Jindal Journal of Business Research.2023; 12(2): 143. CrossRef - How structural changes are driving R&D activity in India’s pharmaceutical sector

Niloufer Sohrabji, Kristen Marquette

Journal of Pharmaceutical Health Services Research.2023; 14(3): 256. CrossRef - Patent and Marketing Exclusivities 101 for Drug Developers

Bryan Oronsky, Scott Caroen, Franck Brinkhaus, Tony Reid, Meaghan Stirn, Raj Kumar

Recent Patents on Biotechnology.2023; 17(3): 257. CrossRef - The driving process of technological innovation in construction: a firm-level CDM analysis

Zheng Gong, Nannan Wang

Construction Innovation .2022; 22(2): 222. CrossRef - Envisioning the challenges of the pharmaceutical sector in the Indian health-care industry: a scenario analysis

Giuseppe Festa, Ashutosh Kolte, Maria Rosaria Carli, Matteo Rossi

Journal of Business & Industrial Marketing.2022; 37(8): 1662. CrossRef - Can the Profitability of Medical Enterprises Be Improved After Joining China's Centralized Drug Procurement? A Difference-in-Difference Design

Yu-Fei Hua, Jin Lu, Bing Bai, Han-Qing Zhao

Frontiers in Public Health.2022;[Epub] CrossRef - Ambidexterity's influence on export strategy development—The case of the Indian pharmaceutical industry

Ashutosh Kolte, Giuseppe Festa, Matteo Rossi, Alkis Thrassou, Demetris Vrontis, Michael Christofi

Thunderbird International Business Review.2022; 64(5): 465. CrossRef - Local pharmaceutical research and development capacity in a developing country: a qualitative exploration of perspectives from key stakeholders in Ethiopia

Muluken Nigatu Selam, Samuel Abera, Helen Geremew, Eskinder Eshetu Ali

Journal of Pharmaceutical Policy and Practice.2022;[Epub] CrossRef - Optimization and Quest of HPMC loaded Stavudine Controlled Release Dosage Development by Central Composite Design utilizing Reduced Factorial Screening Technique

Jyothsna Gangolu, Sandyapakula Balaiah, Sisir Nandi, Harekrishna Roy

Brazilian Journal of Pharmaceutical Sciences.2022;[Epub] CrossRef - The contribution of intellectual capital to financial stability in Indian pharmaceutical companies

Giuseppe Festa, Matteo Rossi, Ashutosh Kolte, Luca Marinelli

Journal of Intellectual Capital.2021; 22(2): 337. CrossRef - Factors affecting profitability of pharmaceutical company: an Indonesian evidence

Harianto Lim, Rofikoh Rokhim

Journal of Economic Studies.2021; 48(5): 981. CrossRef - Impact of Monetary Policy Uncertainty on R&D Investment Smoothing Behavior of Pharmaceutical Manufacturing Enterprises: Empirical Research Based on a Threshold Regression Model

Jingyuan Yang, Ling Wang, Ziyuan Sun, Fangming Zhu, Yihui Guo, Yan Shen

International Journal of Environmental Research an.2021; 18(21): 11560. CrossRef - Drivers of ICT investments in bakery and sugar confectionery processed food sub-sector in India

Navyashree GR, Savita Bhat

Journal of Agribusiness in Developing and Emerging.2020; 10(2): 191. CrossRef - Gouvernance et intensité d’innovation dans les ETI innovantes

Léopold Djoutsa Wamba, Éric Braune, Frédéric Teulon

Management & Avenir.2020; N° 118(4): 111. CrossRef - MALİYET YAPIŞKANLIĞININ YENİDEN GÖZDEN GEÇİRİLMESİ: BORSA İSTANBUL İMALAT SANAYİ ÖRNEĞİ

Mehmet Emin KARABAYIR

Muhasebe ve Vergi Uygulamaları Dergisi.2019; 12(2): 317. CrossRef - Bioaugmentation effect of Aeromonas hydrophila and Pseudomonas putida on kinetics of activated sludge process in treating pharmaceutical industrial wastewater

Marija Vuković Domanovac, Monika Šabić Runjavec, Ernest Meštrović

Journal of Chemical Technology & Biotechnology.2019; 94(8): 2721. CrossRef - Replicating the R&D investments and financial structure relationship: evidence from Borsa İstanbul

Nasif Ozkan

Management Review Quarterly.2018; 68(4): 399. CrossRef - Firm level R&D intensity: evidence from Indian drugs and pharmaceutical industry

Shilpi Tyagi, D. K. Nauriyal, Rachita Gulati

Review of Managerial Science.2018; 12(1): 167. CrossRef - Impact of investment in intangible assets on corporate performance in India

Aparna Bhatia, Khushboo Aggarwal

International Journal of Law and Management.2018; 60(5): 1058. CrossRef - Relation of R&D expense to turnover and number of listed companies in all industrial fields

Jun-Hwan Park, Bangrae Lee, Yeong-Ho Moon, GyuSeok Kim, Lee-Nam Kwon

Journal of Open Innovation: Technology, Market, an.2018; 4(1): 1. CrossRef - Policy to encourage the development of antimicrobials

Ayman Chit, Paul Grootendorst

International Journal of Health Governance.2018; 23(2): 101. CrossRef - O IMPACTO DOS INVESTIMENTOS EM P&D NO DESEMPENHO DAS EMPRESAS: APLICAÇÕES NO USO DE REGRESSÃO QUANTÍLICA COM VARIÁVEIS INSTRUMENTAIS

Leonardo Andrade Rocha, Ahmad Saeed Khan, Patrícia Verônica Pinheiro Sales Lima, Maria Ester Soares Dal Poz, Carlos Alano Soares de Almeida

Revista de Economia Contemporânea.2018;[Epub] CrossRef

PubReader

PubReader Cite

Cite